BTC Price Prediction: Can Bitcoin Reach $200,000 by July-End?

#BTC

- Technical Strength: BTC trades above 20-day MA with MACD convergence, suggesting bullish momentum.

- News Catalysts: Regulatory approvals (stablecoin bill, ETFs) and institutional adoption fuel optimism.

- Key Resistance: 130,000 USDT is the next target; 200,000 remains speculative without macro shifts.

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

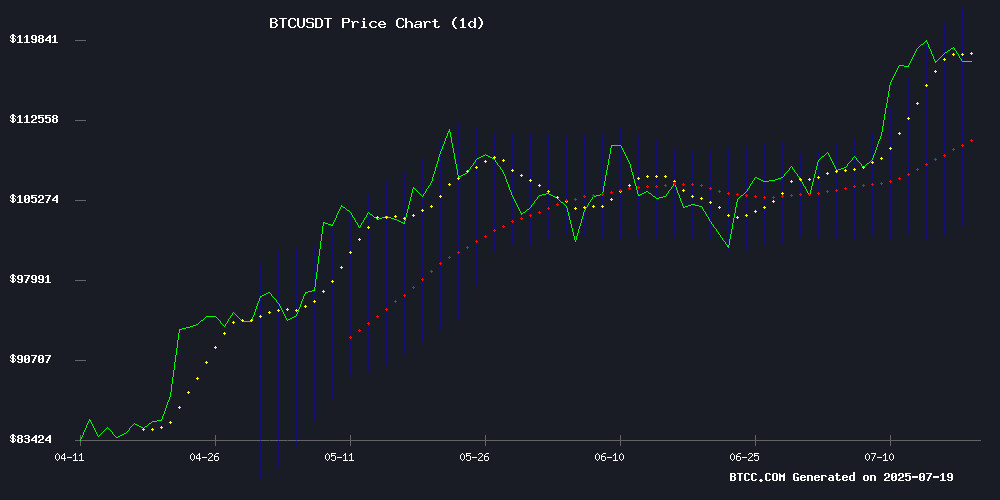

According to BTCC financial analyst Olivia, Bitcoin (BTC) is currently trading at 118,343.74 USDT, above its 20-day moving average (MA) of 113,339.41, indicating a bullish trend. The MACD (12,26,9) shows a negative value but is converging, which could signal a potential reversal. Bollinger Bands suggest volatility, with the price near the upper band at 123,314.18, hinting at possible resistance. Olivia notes that if BTC sustains above the 20-day MA, further upside towards 130,000 USDT is plausible.

Market Sentiment: Positive Catalysts for Bitcoin

BTCC financial analyst Olivia highlights several bullish factors from recent news: Trump's endorsement of Bitcoin, the signing of a stablecoin bill, and institutional interest like 21Shares' ETF filings and Block's S&P 500 inclusion. She cautions that El Salvador's IMF pressures and technical resistance (per Brandt's chart) may temper gains, but overall sentiment aligns with the technical outlook, supporting a potential rally.

Factors Influencing BTC’s Price

Crypto Seed Phrase Explained Easily 2025

The crypto seed phrase, a cornerstone of digital asset security, functions as a human-readable backup for private keys. Its loss or exposure can result in irreversible access denial or theft, underscoring its critical role in cryptocurrency management.

Rooted in hierarchical deterministic (HD) wallet technology introduced via Bitcoin Improvement Proposal 39 (BIP-39) in 2012, the seed phrase generates a sequence of 12-24 words during wallet creation. This mechanism ensures deterministic key derivation, enabling seamless wallet recovery across devices while maintaining cryptographic integrity.

Trump Praises Bitcoin's Outperformance, Signs Landmark Stablecoin Bill

Former President Donald Trump highlighted Bitcoin and cryptocurrencies' superior performance compared to traditional stocks during a speech following his signing of the GENIUS Act stablecoin bill. The legislation marks the first federal crypto bill in U.S. history, signaling a regulatory shift for digital assets.

Trump contrasted the current administration's approach with what he described as the Biden-era marginalization of crypto, citing SEC Chair Gary Gensler's policies as particularly hostile. The stablecoin bill's passage represents a turning point for an industry that Trump claims was "mocked and dismissed" until his intervention.

Institutional interest in cryptocurrency has grown noticeably since Trump began engaging with the sector. The market has responded favorably to these developments, with Bitcoin leading a broad crypto rally that has outpaced traditional equity markets over the past year.

Bitcoin Poised for Gains Amid US Dollar Weakness, Analyst Says

Renowned analyst Jason Pizzino suggests Bitcoin's rally may accelerate as the US dollar shows persistent weakness. The inverse correlation between the dollar and crypto assets appears to be strengthening, with investors increasingly viewing digital currencies as hedges against fiat depreciation.

"This is good news for Bitcoin at this stage of the cycle," Pizzino noted, forecasting continued dollar declines. The analyst observes Bitcoin's upward momentum coinciding with dollar weakness, a pattern that historically favors alternative assets.

Market dynamics reveal growing institutional interest in crypto during periods of dollar softness. While traditional markets still influence Bitcoin's price action, the cryptocurrency increasingly moves to its own macroeconomic rhythms.

El Salvador's Bitcoin Strategy Stalls Amid IMF Pressure

El Salvador's pioneering Bitcoin experiment faces headwinds as the International Monetary Fund imposes restrictions on state crypto activities. The Central American nation, which adopted BTC as legal tender in 2021 under President Nayib Bukele's leadership, hasn't purchased any Bitcoin since December 2024 according to IMF disclosures.

The government's daily Bitcoin accumulation strategy—announced with fanfare in November 2022—appears suspended despite public assurances to the contrary. This slowdown coincides with El Salvador's $1.4 billion IMF bailout agreement finalized in February 2025, which explicitly discourages public-sector crypto transactions.

Bukele's administration continues projecting pro-Bitcoin rhetoric through official channels, but the IMF's latest report reveals a stark disconnect between political posturing and fiscal reality. The standoff highlights growing tensions between cryptocurrency adoption and traditional financial oversight in sovereign debt scenarios.

Bitcoin Price Could Hit New Highs by July-End, Says Galaxy Digital

Bitcoin's rally to a record $123,000 has injected optimism into the market, though sentiment remains divided. The cryptocurrency now hovers near $118,000—a consolidation that Galaxy Digital's Michael Harvey interprets as a temporary pause before potential upward momentum resumes later this month.

Harvey, head of franchise trading at the firm, outlines two scenarios. A bullish case hinges on sustained ETF inflows, corporate treasury accumulation, and retail participation—a "slow melt-up" trajectory. Spot Bitcoin ETFs continue demonstrating robust demand, while institutional adoption shows no signs of slowing. Retail interest, however, remains the missing piece; though Coinbase's app ranking has climbed, Google search volume for "Bitcoin" stays subdued.

The alternative scenario involves a 5-10% correction toward $110,000, triggered by profit-taking or broader equity market weakness. Such a pullback would test investor conviction before any renewed rally.

Jack Dorsey’s Block to Join the S&P 500 Index Next Week

Block Inc., the fintech firm behind Cash App, will replace Hess Corp. in the S&P 500 index starting July 23. The move follows Chevron's acquisition of Hess, marking another crypto-friendly company's entry into the benchmark index after Coinbase's inclusion last May.

The company's substantial Bitcoin holdings - 8,585 BTC purchased at an average of $30,405 - now represent a 300% unrealized gain. This institutional endorsement comes as regulatory clarity improves, with the recent passage of the GENIUS Act under President Trump.

Block's stock surged 10% in after-hours trading to $79.49, capping a 35% quarterly rally. The market views this development as a significant step toward mainstream Bitcoin adoption by traditional investors.

21Shares Files for Two Crypto Fund ETFs With the U.S. SEC

21Shares, a crypto investment firm managing over $11 billion in assets, has partnered with Teucrium to file two new ETFs with the SEC. The 21Shares FTSE Crypto 10 Index ETF will track the top ten cryptocurrencies by market cap, while the 21Shares FTSE Crypto 10 ex-BTC Index ETF excludes Bitcoin, offering investors diversified exposure to digital assets.

"Investors seek accessible avenues to capitalize on crypto's growth," said Federico Brokate, Head of U.S. Business at 21Shares. The funds leverage established U.S. securities frameworks, including 1940 Act structures, to provide tax familiarity and regulatory compliance.

The move underscores institutional momentum toward tokenized assets as regulatory clarity improves. Both ETFs aim to meet rising demand for regulated crypto investment vehicles without requiring direct asset custody.

Smarter Web Company Secures £17.5M to Expand Bitcoin Treasury Strategy

Smarter Web has raised £17.5 million through an accelerated equity offering, selling 5.9 million shares at £2.95 each to institutional investors. The proceeds will fuel its aggressive Bitcoin accumulation plan, reinforcing a decade-long treasury strategy.

The company recently acquired 325 BTC for £27.15 million at an average price of £83,525 per coin, following a prior purchase of 275 BTC at $108,182 each. Since April, Smarter Web has amassed 1,600 BTC, demonstrating unwavering commitment to its digital asset reserve policy.

Australia Approves First Bitcoin-Backed Mortgage After Legal Win

Australia has introduced its first Bitcoin-backed home loan following a court ruling in favor of Block Earner. The Federal Court ruled that Block Earner’s crypto lending products are not classified as financial products, allowing the firm to bypass traditional licensing requirements.

Borrowers can now use Bitcoin to secure up to 50 percent of a property’s value through a crypto-collateralized loan. The remaining balance is financed via conventional mortgage structures, creating a hybrid financing model. Fireblocks, a institutional-grade custody provider, safeguards the Bitcoin collateral.

The development comes amid Australia’s worsening housing affordability crisis. With home prices reaching 10 times average incomes—and 14 times in Sydney—the product offers alternative access to capital for crypto holders. The ruling sets a precedent for crypto’s integration into mainstream financial services.

Bitcoin Faces Critical Technical Test as Brandt's Chart Signals Pivotal Moment

Bitcoin stands at a decisive juncture according to veteran trader Peter Brandt's newly released 15-year logarithmic chart. The analysis reveals a curved price pattern resembling a banana's arc, with BTC currently testing the $118,000 resistance level—a make-or-break threshold that could determine the next major market direction.

The chart presents two stark possibilities: either a decisive breakout confirming the continuation of Bitcoin's historic uptrend, or a breakdown that would mark the first structural failure of this pattern since 2010. Brandt's analysis notably refrains from specifying price targets, instead highlighting the increasing probability of a significant volatility expansion.

Market participants remain divided as Bitcoin's price action tests the lower boundary of this long-standing technical structure. The coming weeks may prove critical for determining whether the cryptocurrency maintains its 15-year bullish trajectory or faces a fundamental technical breakdown.

Top 5 Cloud Mining Platforms in 2025: A Strategic Overview

Cloud mining continues to solidify its position as a viable passive income stream for cryptocurrency investors, particularly as hardware costs and energy complexities create barriers to entry for solo mining operations. The 2025 landscape features platforms offering varying degrees of transparency, scalability, and asset diversity—critical factors for ROI optimization in an increasingly institutionalized sector.

BeMine emerges as the standout contender, distinguishing itself through physical ASIC ownership options and altcoin diversification. Its trial mining feature—offering free Antminer S21 Hydro usage—provides rare market transparency for risk assessment. Binance Cloud Mining leverages ecosystem synergies for seamless integration, while Bitdeer caters to capital-heavy investors. Bitmain-backed BitFuFu and veteran operator Hashing24 round out the top tier with institutional-grade infrastructure.

The sector's maturation reflects broader industry trends: mining profitability now hinges on operational sophistication as much as cryptocurrency prices. Platforms enabling BTC and altcoin exposure—like BeMine's multi-asset support—are particularly well-positioned as investors hedge against Bitcoin's dominance volatility.

Will BTC Price Hit 200000?

Olivia from BTCC suggests that while BTC's technicals and news-driven momentum are strong, reaching $200,000 by July-end is ambitious. Key data:

| Metric | Value |

|---|---|

| Current Price | 118,343.74 USDT |

| 20-Day MA | 113,339.41 (Support) |

| Bollinger Upper Band | 123,314.18 (Resistance) |

She notes that breaking above 130,000 USDT could open a path to 150,000, but $200,000 would require unprecedented inflows or macro triggers.

| Metric | Value |

|---|---|

| Current Price | 118,343.74 USDT |

| 20-Day MA | 113,339.41 |

| Bollinger Upper Band | 123,314.18 |